The PFAS Action Act

A bipartisan senate bill was introduced on March 1 to mandate the Environmental Protection Agency (EPA) classify Per- and Polyfluoroalkyl Substances (PFAS) as hazardous substances eligible for cleanup under the Superfund toxics law, a massive step in efforts to eliminate widespread contamination by these compounds across the country. Under the PFAS Action Act of 2019, legislation would require responsible parties to report the excess release of PFAS into the environment and allow the government to sue polluters to recover the costs of cleanup.

Scott Faber, Senior Vice President of Government Affairs at the Environmental Working Group (EWG) said that “this proposal could assist potentially hundreds of communities throughout the country struggling with PFAS contamination by securing the resources required to begin the cleanup process and holding polluters accountable.”

What are PFAS?

PFAS are manmade chemicals that have been used in both industry and consumer products since the 1950s. The most common products that PFAS are used in include:

- Non-stick cookware

- Products that resist grease, water and oil

- Water-repellant clothing

- Stain resistant fabrics

- Firefighting foams

- Some cosmetics

Exposure to PFAS can happen through a variety of ways including:

- Drinking contaminated municipal water or private well water

- Eating fish caught from a source that was contaminated with PFAS

- Swallowing contaminated soil or dust

- Eating food that was packaged in material containing PFAS

- Using consumer products including the ones listed above

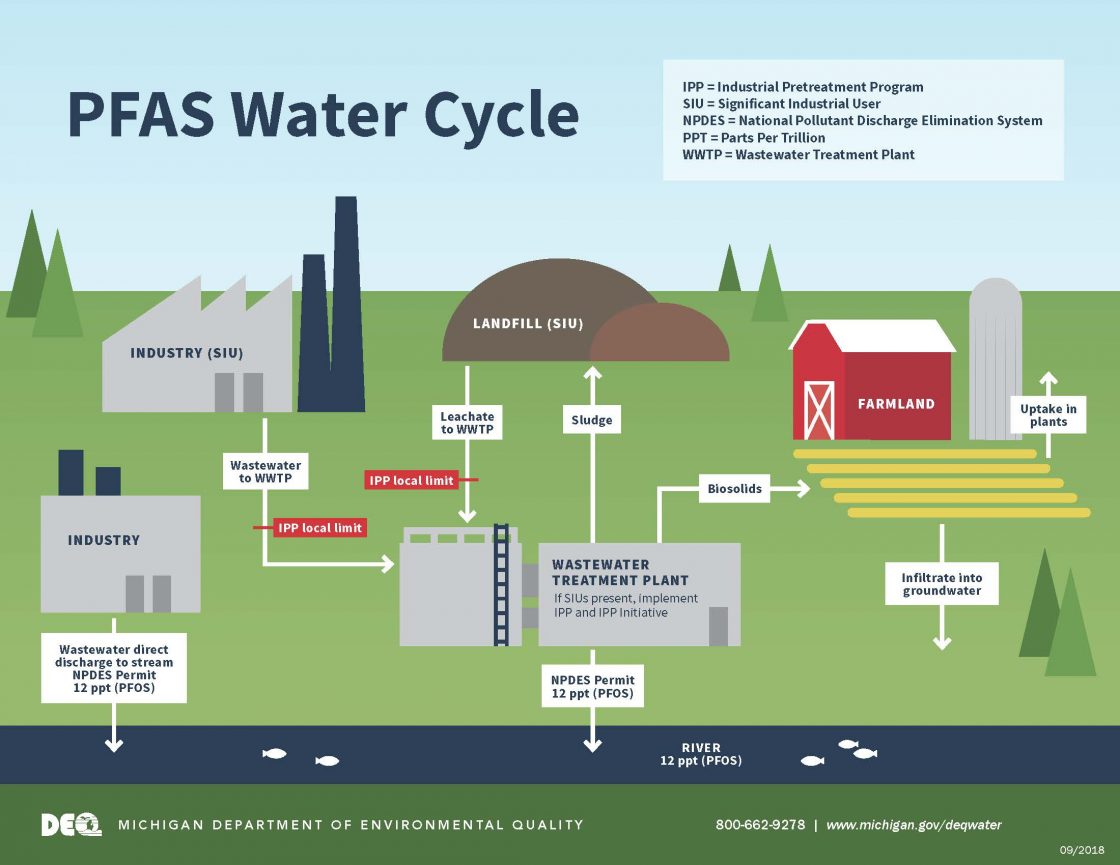

As PFAS are produced and used, they can migrate into soil and water inducing hugely detrimental effects on the environment, people, and animals. While scientists are still learning about the health effects to exposure of PFAS, some studies show that PFAS exposure may affect:

- Growth

- Learning

- Behavior of infants and children

- The ability to get pregnant

- Natural hormones in the body

- Cholesterol levels

- Immune system

- Risk of cancer

Why is the PFAS Action Act of 2019 Necessary?

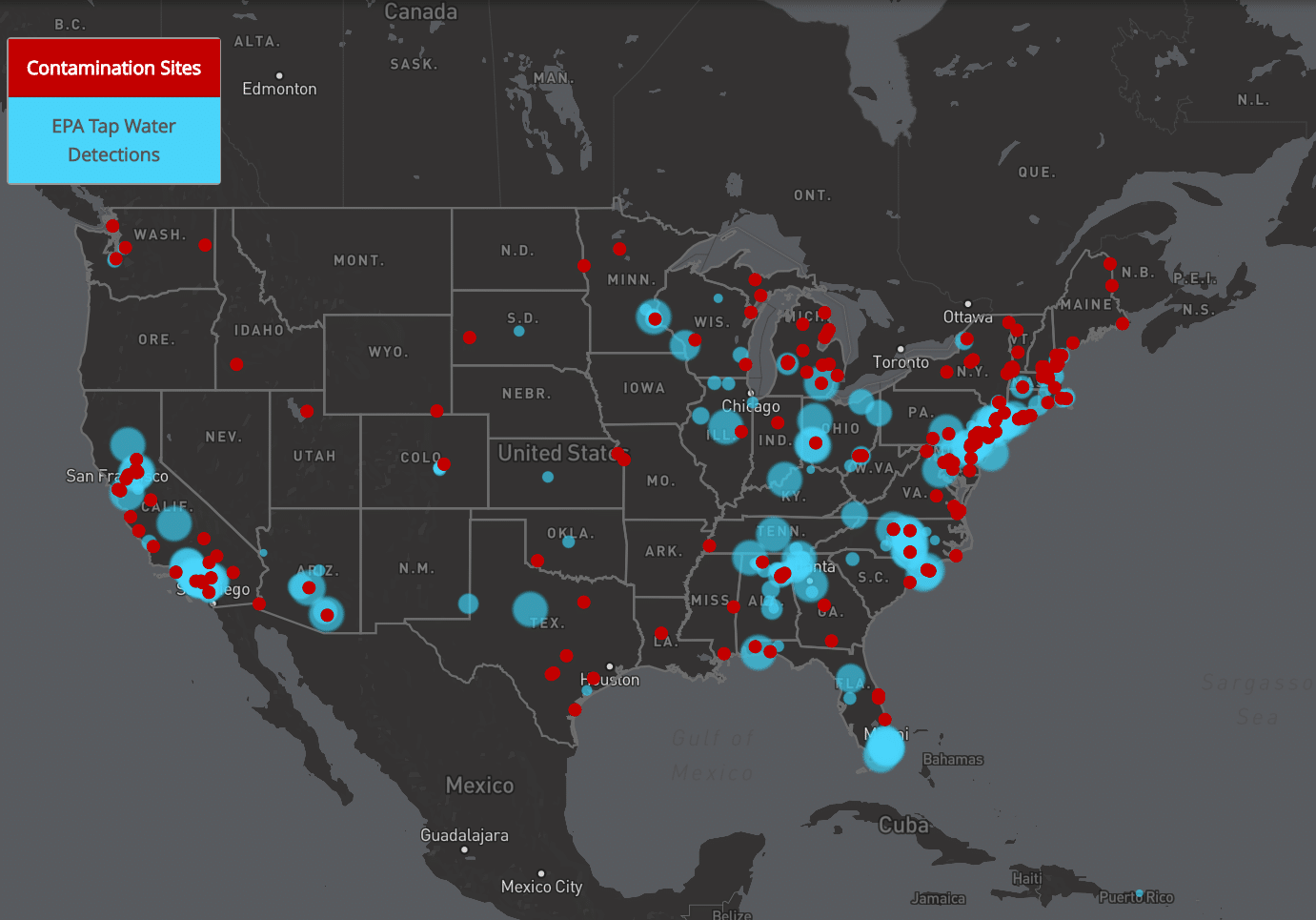

Tests performed by the EPA have detected PFAS pollution of public water supplies for 16 million Americans in 33 states, a statistic that is considered a severe underestimate of the scope of the problem. EWG and researchers at Boston’s Northeastern University have tracked 172 PFAS contamination sites in 40 states – a number that does not include public water systems with PFAS contamination. In May 2018, EWG released a data analysis that estimated more than 1,500 drinking water systems, serving up to 110 million Americans, may be contaminated with similar fluorinated chemicals.

The map below from EWG and SSEHRI at Northeastern University shows contamination sites and EPA tap water detections. Click here to view an interactive version of this map. The blue circles show where PFAS chemicals were detected between 2013 and 2016 in public drinking water systems, and the red circles show sites in Northeastern’s PFAS Contamination Site Tracker.

Should this bill be enacted into law, these 1,500 contaminated drinking water systems across the country would soon be cleaned up as part both short-term and long-term actions included in the Action Plan, potentially resulting in clean water supplies and safe drinking water.

PFAS Action Act – Action Items

The EPA is leading the national effort to understand PFAS and reduce risks to the public through implementation of this Action Plan and through active engagement and partnership with other federal agencies, states, tribes, industry groups, associations, local communities, and the public.

Key actions to PFAS related challenges include:

- Expanding toxicity information for PFAS

- Developing new tools to characterize PFAS in the environment

- Evaluating cleanup approaches

- Developing guidance to facilitate the cleanup of contaminated groundwater

- Using enforcement tools to address PFAS exposure in the environment

- Using legal tools such as those in the Toxic Substances Control Act (TSCA) to prevent future PFAS contamination

- Addressing PFAS in drinking water using regulatory and other tools

- Developing new tools and materials to communicate about PFAS

(See all priority actions, short-term actions, and long-term actions here.)

1ewg.org

2shaheen.senate.gov

3epa.org

4atsdr.cdc.gov

5michigan.gov

Emergency Response Plans (ERPs) are mandatory for all public water suppliers, and a minimum of 10 hours of Emergency Response Training is required. ERP training is a process that helps water system managers and staff explore vulnerabilities, make improvements, and establish procedures to follow during an emergency. Preparing and practicing an ERP can save lives, prevent illness, enhance system security, minimize property damage, and lessen liability.

Emergency Response Plans (ERPs) are mandatory for all public water suppliers, and a minimum of 10 hours of Emergency Response Training is required. ERP training is a process that helps water system managers and staff explore vulnerabilities, make improvements, and establish procedures to follow during an emergency. Preparing and practicing an ERP can save lives, prevent illness, enhance system security, minimize property damage, and lessen liability.

T&H kicked off EOM with our Employee Breakfast & Presentation on October 1st. We are encouraging our employees to participate in weekly hosted games and activities to gain points for their teams – which will be modeled after the Houses of Harry Potter’s Hogwarts School. The House with the most points at the end of the month will win the House Cup! Other fun activities include a cornhole tournament, poker night, lunchtime Jeopardy, pumpkin decorating, the firm’s Anniversary Lunch, and wrapping up with the Pie in the Eye Day.

T&H kicked off EOM with our Employee Breakfast & Presentation on October 1st. We are encouraging our employees to participate in weekly hosted games and activities to gain points for their teams – which will be modeled after the Houses of Harry Potter’s Hogwarts School. The House with the most points at the end of the month will win the House Cup! Other fun activities include a cornhole tournament, poker night, lunchtime Jeopardy, pumpkin decorating, the firm’s Anniversary Lunch, and wrapping up with the Pie in the Eye Day.

The most alarming news is the hottest temperature ever reliably recorded reached 124.3 degrees in Algeria this July.

The most alarming news is the hottest temperature ever reliably recorded reached 124.3 degrees in Algeria this July. Wastewater treatment plants that use aerobic bacteria must provide oxygen with huge and costly electrically powered blowers for these microorganisms to survive. Anaerobic bacteria treatment processes do not need oxygen and use considerably less energy, making the wastewater treatment process more economical to operate. In addition to saving money, engineers believe these anaerobes can filter household and industrial chemicals better than conventional treatment plants.

Wastewater treatment plants that use aerobic bacteria must provide oxygen with huge and costly electrically powered blowers for these microorganisms to survive. Anaerobic bacteria treatment processes do not need oxygen and use considerably less energy, making the wastewater treatment process more economical to operate. In addition to saving money, engineers believe these anaerobes can filter household and industrial chemicals better than conventional treatment plants.

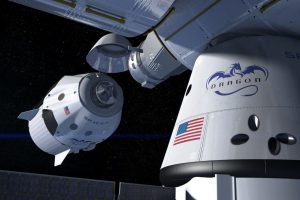

When NASA recently announced the discovery of liquid water flowing under an ice cap on Mars, it opened the exciting possibility that life may exist outside our earthly abode. While it is conceivable scientists may eventually discover life somewhere in our galaxy, a reliable source of water outside earth is fundamental for the possibility of establishing a colony on Mars, exploring the universe and even visiting distant planets in search of life outside earth.

When NASA recently announced the discovery of liquid water flowing under an ice cap on Mars, it opened the exciting possibility that life may exist outside our earthly abode. While it is conceivable scientists may eventually discover life somewhere in our galaxy, a reliable source of water outside earth is fundamental for the possibility of establishing a colony on Mars, exploring the universe and even visiting distant planets in search of life outside earth. But hauling tons of supplies and materials to the International Space Station (ISS) is inefficient and extremely expensive. Sustaining a crew of four astronauts on the ISS with water, power and other supplies, costs nearly one million dollars a day. Even with the reusable SpaceX rocket which regularly provides supplies to the ISS, it costs $2,500 per pound to launch into space. With four astronauts living on the ISS needing approximately 12 gallons of water a day, it is impractical to stock the ISS with the tons of water needed for long periods of time.

But hauling tons of supplies and materials to the International Space Station (ISS) is inefficient and extremely expensive. Sustaining a crew of four astronauts on the ISS with water, power and other supplies, costs nearly one million dollars a day. Even with the reusable SpaceX rocket which regularly provides supplies to the ISS, it costs $2,500 per pound to launch into space. With four astronauts living on the ISS needing approximately 12 gallons of water a day, it is impractical to stock the ISS with the tons of water needed for long periods of time. If the idea of drinking reclaimed water from mice urine and other waste sources sounds unappetizing, consider this, the water the astronauts drink is often cleaner that what many earthlings drink. NASA regularly checks the water quality and it is monitored for bacteria, pollutants and proper pH (60 – 8.5).

If the idea of drinking reclaimed water from mice urine and other waste sources sounds unappetizing, consider this, the water the astronauts drink is often cleaner that what many earthlings drink. NASA regularly checks the water quality and it is monitored for bacteria, pollutants and proper pH (60 – 8.5). Recently, NASA invested in a new, lower cost solution to biologically recycle and reuse water developed by

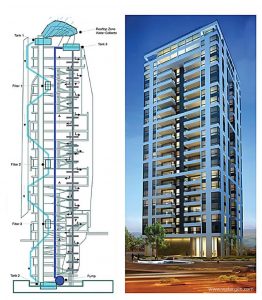

Recently, NASA invested in a new, lower cost solution to biologically recycle and reuse water developed by  Pancopia is currently working on a similar system used on the ISS for municipal wastewater facilities. Using the technology developed for the Space Station, other areas in the world with limited access to clean drinking water, will soon be able to utilize this advanced water filtration and purification system.

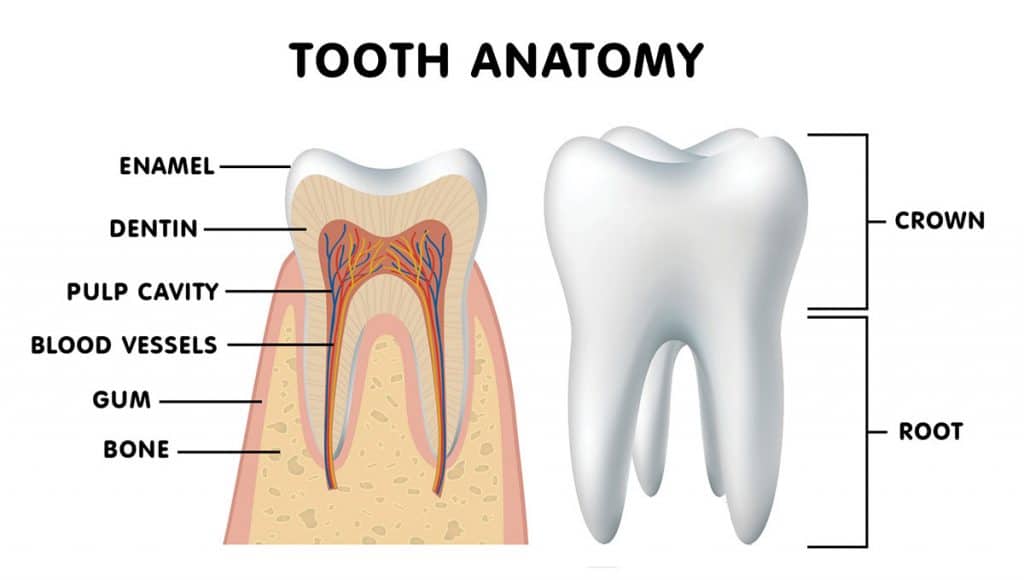

Pancopia is currently working on a similar system used on the ISS for municipal wastewater facilities. Using the technology developed for the Space Station, other areas in the world with limited access to clean drinking water, will soon be able to utilize this advanced water filtration and purification system. Even so, that millimeter of enamel making up the outer part of the tooth is the hardest substance of the human body and can outlast even the human skeleton when interred. In fact, the oldest vertebrate fossil relics going back 500 million years are teeth. Despite these details, teeth can be surprisingly fragile and prone to decay.

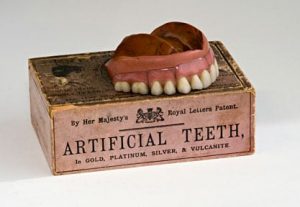

Even so, that millimeter of enamel making up the outer part of the tooth is the hardest substance of the human body and can outlast even the human skeleton when interred. In fact, the oldest vertebrate fossil relics going back 500 million years are teeth. Despite these details, teeth can be surprisingly fragile and prone to decay. Still, with these advances in dentistry, tooth loss and decay persisted. Since ancient times, it was widely thought that toothaches were caused by worms that destroyed teeth. It wasn’t until 1890, when a dentist named Willoughby Miller identified that tooth decay was caused by a certain type of bacteria that thrives on sugar, creating an acid that ate away at tooth enamel.

Still, with these advances in dentistry, tooth loss and decay persisted. Since ancient times, it was widely thought that toothaches were caused by worms that destroyed teeth. It wasn’t until 1890, when a dentist named Willoughby Miller identified that tooth decay was caused by a certain type of bacteria that thrives on sugar, creating an acid that ate away at tooth enamel.